Posts Tagged ‘Worksite Enforcement’

Thursday, August 16th, 2012

The Department of Justice Office of Public Affairs recently published a press release pertaining to the employment of two refugees resolving allegations that the company discriminated under the anti-discrimination provision of the Immigration and Nationality Act (INA), when it impermissibly delayed the start date of two refugees after requiring them to provide specific Form I-9 documentation. Best Packing’s violations occurred when they required the refugees to supply the company with additional Form I-9 verification documents in excess of the law. The claim alleged that other non-refugee employees were not required to supply documents other than state issued licenses and social security cards.

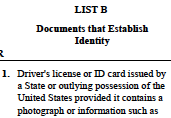

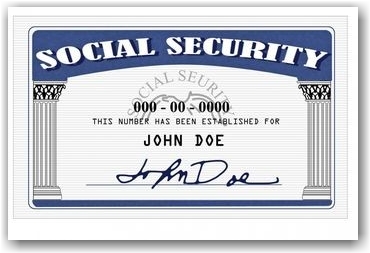

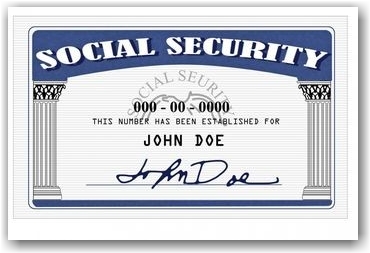

In two charges filed with the department, the refugees alleged that they were not allowed to begin employment until they produced unexpired, Department of Homeland Security-issued employment authorization documents, despite the fact that they initially presented sufficient documentation for employment eligibility verification purposes. The charging parties had presented unexpired state identification cards and unrestricted Social Security cards. The state ID’s and unrestricted SS cards were deemed insufficient proof of work authorization.

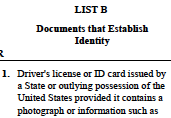

It is necessary for all those charged with Form I-9 processing at your organization to be very familiar with the list of acceptable documents and to have a thorough understanding of the fact that each employee has the right to present a list A document or a combination B plus C document as long as they are acceptable documents, appear to be genuine and represent the employee that is before you.

Under the settlement agreement, Best Packing agreed to pay $4,379 in back pay and comply with all the requirements of the INA. Understanding the Form I-9 requirements for verifying refugee/asylee(s) will prevent your company from falling victim to similar discriminatory hiring practices.

The process by which an employer is required to verify the employment eligibility of a refugee/asylee(s) when presented with documentation other than the above-referenced List B plus List C combination, can be a bit complicated. Let’s review this.

Asylees and Refugees are individuals seeking the protection of the United States due to persecution suffered in the home country based upon: race, religion, nationality, social group, or political ideology. These individuals are authorized to work in the US because of their immigration status. When presented with documentation of asylum or refugee status, it is advisable to be aware of the following in regard to examining the I-9 form and the documents presented:

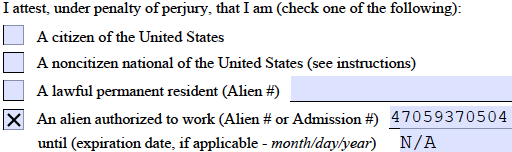

SECTION 1:

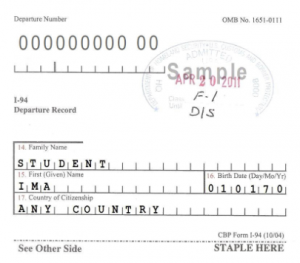

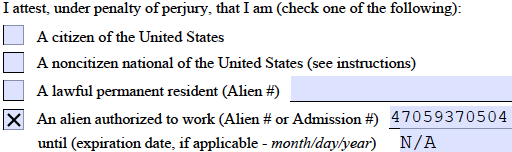

- The employee should check the “An alien authorized to work” box

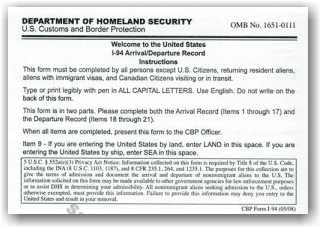

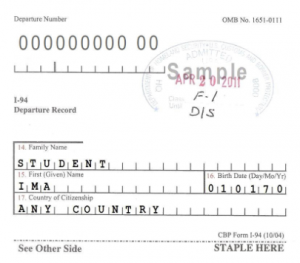

- Write the I-94 or Alien Registration Number in the first space

- Write “N/A” in the second space, because their employment authorization does not expire

SECTION 2:

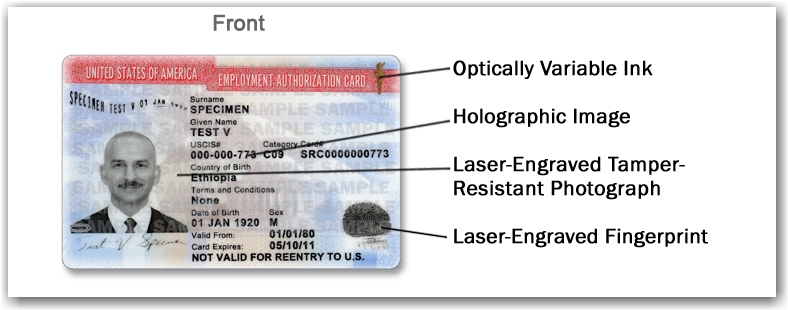

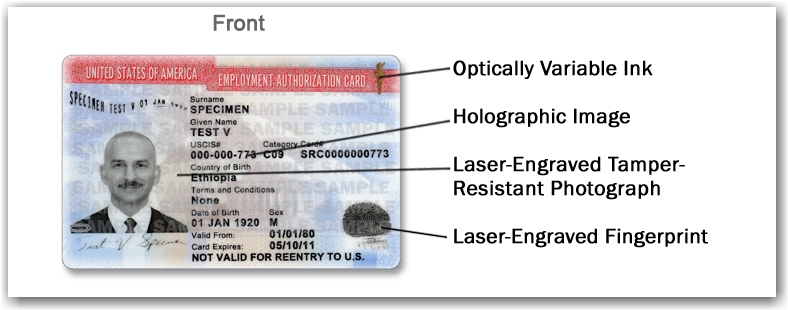

Acceptable Documents are I-94, I-766, or their Employment Authorization Document also known as an EAD card

NOTE: this section presents two different scenarios that require strict attention to time restrictions and combinations of required documents to be presented in order to comply with the USCIS regulations. To complete this section choose from the applicable scenarios below:

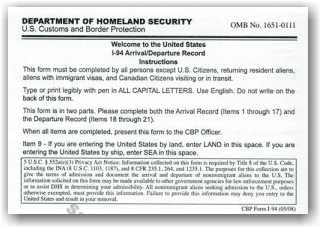

Scenario One: Refugee presents a Form I-94:

When presented with a Form I-94 containing an unexpired refugee admission stamp, the employer must accept it as a receipt establishing both employment authorization and identity for 90 days. After 90-days, the employee must present either an EAD or a combination of a List B document and List C (an unrestricted social security card.)

Scenario Two: Asylee presents a Form I-94:

An employer must accept Form I-94 or Form I-94A with one of the stamps or notations below indicating asylee status:

- Asylum granted indefinitely

- 8 CFR 274a.12(a)(5)

- INA 208

This is a List C document that does not require/contain an expiration date. However, the asylee will need to present a List B identity document with this Form I-94.

*Decisions from immigration judges granting asylum are not acceptable.

For further assistance on training your company’s hiring personnel on all of the requirements of Form I-9 compliance, contact one of our immigration professionals at info@immigrationcompliancegroup.com or call 562 612.3996.

Tags: Best Packaging I-9 Ruling, DOJ, I-9 Acceptable Documents, I-9 Anti-Discrimination Provision, I-9 Discrimination, I-9 Document Examination, I-9 for Refugees/Asylees, I-9 Over-Documentation, I-9 Training, I-9/E-Verify News, ICE, OSC, Worksite Enforcement

Posted in Employer Compliance, I-9/E-Verify News, ICE, Immigration News, Uncategorized, USCIS | Comments Off on Form I-9 How To Guide: Employing Refugee/Asylee(s)

Friday, August 3rd, 2012

By: Timothy Sutton, Communications Editor

By: Timothy Sutton, Communications Editor

Shortly after ICE began their Form I-9 audit of the San Antonio based sushi chain, Sushi Zushi, an exodus of employees forced the company into a weeklong-statewide shutdown. After an internal announcement by Sushi Zushi management to employees of the routine audit, a wave of scared employees did not return to their jobs on Friday Morning. A public statement was issued by Sushi Zushi’s public relations spokesperson; Judy McCarter detailing the company’s decision:

STATEMENT FROM SUSHI ZUSHI, Friday, July 27, 2012

Sushi Zushi has temporarily suspended its operations and closed its restaurants in San Antonio, Austin and the DFW Metroplex. We plan to resume operations as soon as possible.

The decision to close the restaurants was made at Sushi Zushi today by executive management due to an unanticipated internal reaction to news of a routine I-9 audit. Several vital employees have chosen not to report to work. This has affected our ability to provide our expected level of service to guests. CEO Alfonso Tomita is returning from travels outside the country.

Sushi Zushi’s policy is to comply with all federal, state and local laws and regulations. And Sushi Zushi has made its best efforts to comply with I-9 requirements always done appropriate due diligence on all its staff. Sushi Zushi is working with legal counsel to respond to the government’s audit.

We wish to be clear – there was no raid by the government on our operations. Nor has any employee been detained by the government or terminated by the company. Sushi Zushi is responding to a routine I-9 audit. We apologize in advance for the inconvenience and appreciate the patience of our loyal guests while we work through this issue.

Company management immediately posted want ad’s on Craigslist and Facebook. Their customers posted their concerns across social media, including accusations of mismanagement that surfaced on reddit.com. In the midst of this audit meltdown, an employee announced via facebook that he was promoted from delivery driver to sushi chef. With the company’s reputation spinning out of control, their facebook page had posts of former kitchen employees who remarked, “The food won’t be the same without us,” while other employees joked with friends that they had a week-off work to “fill out their I-9 forms.”

Before ICE issues a dollar of fines or fees, Sushi Zushi will suffer hundreds of thousands in loses and devastating harm to their reputation. Sushi Zushi employees fled because they were not educated on the differences between an I-9 audit and deportation raids. Clearly, today’s ICE audits are shaping up to be equally as effective in deterring unlawful employment as raids of the past. To prevent your company from becoming the next Sushi Zushi, contact our immigration professionals for their expert knowledge on Form I-9 compliance, and sign up to receive our information and visit our Employer Resource Center: www.I-9Audits.com

Tags: I-9 AUDIT, I-9 Fines, I-9 management, I-9 Training, I-9/E-Verify News, ICE Audit, Legal Workforce, Sushi Zushi Audit, Undocumented Workers, Worksite Enforcement

Posted in I-9/E-Verify News, ICE, Immigration News, USCIS | Comments Off on Form I-9 Audit Prompts Sushi Zushi Closure – Fish on ICE

Saturday, July 21st, 2012

By: Timothy Sutton, Communications Editor

Swiss based Nestle has discovered “numerous” violations of its internal work rules as a result of internal auditing aimed at combatting child labor. The manufacturer of Kit-Kat bars reported that four-fifths of its cocoa comes from unmonitored labor channels. The Fair Labor Association is insisting Nestle implement higher supply chain standards moving forward. The cocoa industry is fraught with child labor issues, with child worker rates reaching upwards of 89% in the Ivory Coast. Unfortunately this far-reaching problem will not be solved overnight, “The complexity of child labor in the cocoa supply chain means solving the problem will take years,” Nestle said.

As a result of Nestle’s voluntary audit, the company has avoided penalties thus far. However, their involvement in child labor comes at a price. The company is now committed to altering supply chain practices and will invest heavily in future monitoring services.

While most American businesses can rest assured they are not supporting the underground child-labor industry, Nestle’s efforts to self-assess and reform should be applauded. Domestic and international companies will benefit greatly from routine internal audits that track workforce compliance. USCIS and ICE encourage employers to frequently perform internal audits of their Form I-9 practices. In fact, records of regular auditing of your workforce may help you avoid hefty civil penalties in the event of an official government audit. The next time you “break off a piece of that Kit-Kat bar,” consider following Nestle’s example of self-auditing and contact one of our immigration professionals at info@immigrationcompliancegroup.com or call 562 612.3996.

Other resources:

Tags: Child Labor Laws, E-Verify, Fair Labor Association, I-9 Audits, I-9 Compliance, I-9 Training, I-9/E-Verify News, Legal Workforce, Nestle, Voluntary Audits, Worksite Enforcement

Posted in Department Of Homeland Security (DHS), I-9/E-Verify News, ICE, Immigration News | Comments Off on Nestle KID-Kat Bars?: Audit Helps Chocolate Maker “Grow Up”

Friday, May 11th, 2012

By Timothy Sutton, Communications Editor | Immigration Compliance Group

Amendments to The Racketeer Influenced and Corrupt Organization Act (RICO) in 1996 expose businesses to civil liability for knowingly hiring illegal workers. RICO was originally enacted to protect businesses from the influence of the mafia by allowing private enforcement of sanctions against violators of racketeering laws. Today, if a business employs illegal workers both (1) private individuals who are directly and adversely affected by loss or depression of wages due to employment of illegal workers and (2) businesses who are proximately harmed by a direct competitors employment of illegal workers may seek monetary sanctions including attorney’s fees under RICO. Simply, if you are employing illegal workers, your legally employed workers and your direct competitors may sue you for racketeering.

Amendments to The Racketeer Influenced and Corrupt Organization Act (RICO) in 1996 expose businesses to civil liability for knowingly hiring illegal workers. RICO was originally enacted to protect businesses from the influence of the mafia by allowing private enforcement of sanctions against violators of racketeering laws. Today, if a business employs illegal workers both (1) private individuals who are directly and adversely affected by loss or depression of wages due to employment of illegal workers and (2) businesses who are proximately harmed by a direct competitors employment of illegal workers may seek monetary sanctions including attorney’s fees under RICO. Simply, if you are employing illegal workers, your legally employed workers and your direct competitors may sue you for racketeering.

In Trollinger v. Tyson Foods, Inc., legally authorized workers filed a civil RICO class action against Tyson claiming the company and its recruiters had violated the INA by entering into an illegal hiring scheme to pay illegal aliens lower wages to increase profits. The workers claimed that their own wages had been depressed by Tyson’s immigration violations. Tyson prevailed after six long years of civil litigation because the plaintiff’s failed to establish a sufficient causation of their lost wages by Tyson’s hiring of illegal workers. However, this case set out the framework for employees to bring a lawsuit against their employer for hiring illegal workers under RICO.

Because the government holds private businesses accountable for enforcing immigration laws through I-9 compliance, E-verify and various Federal statutes, workplace compliance is essential to protecting your business. Businesses, not illegal workers are held accountable for fraudulent documents, misrepresentations of citizenship, and discriminatory hiring practices.

As “gatekeepers,” of immigration enforcement, employers have a de-facto duty to prevent illegal immigrants from securing employment. To ensure that your business is prepared for RICO lawsuits, ICE audits, and OSC hiring discrimination claims, contact one of our immigration professionals at info@immigrationcompliancegroup.com or call 562 612.3996.

Our Employer Resource Center is very informative – check it out.

Tags: Employment Eligibility Verification, I-9 Form, I-9/E-Verify News, ICE Audits, ICE Investigation, Illegal Workers, Immigration Compliance Group, Legal Workforce, OSC, RICO Act, Undocumented Workers, Worksite Enforcement

Posted in I-9/E-Verify News, ICE, Immigration News | Comments Off on I-9 Form: Can An Anti-Mafia Law Criminalize Your Legitimate Business?

Tuesday, May 8th, 2012

By: Timothy Sutton, Communications Editor

By: Timothy Sutton, Communications Editor

Like many successful restaurant managers, I worked my way up from the bottom of the employee food chain. That meant with each promotion from bus boy to manager, I was trained by other employees on how to do my job. By the time I became a General Manager, I erroneously believed that being a good manager meant being able to follow established procedures. I soon discovered that this was actually a recipe for disaster.

Auditioning a new waiter is a common practice in the restaurant industry. This entails observing an applicant voluntarily interacting with customers, taking orders, serving food and working with other employees. Typically, the audition ends with a free meal in exchange for the waiter’s time and parking validation if the restaurant is generous. Throughout the industry, restaurateurs believe that this practice limits their liability because the applicant has not yet become an employee in “volunteering,” their time to audition for the job.

However, the M-274 Handbook For Employers instructions on completing form I-9 (Employment Eligibility Form) classifies this practice of meals and parking reimbursement as remuneration: anything of value given in exchange of labor or services, including food or lodging. Because restaurant managers typically train one another on hiring practices, there is a perpetual false belief that auditioning waiters is a healthy hiring practice. According to the M-274, the work done in exchange for the value of a meal exposes restaurants to form I-9 non-compliance fines. Essentially, the audition becomes Day One of employment, which requires I-9 forms to be completed and retained.

If the applicant is not hired, both Section 1 and 2 of the I-9 form must be completed that same-day in order to comply with rules regarding employees retained for three-days or less. Without the proper knowledge and training on these I-9 compliance issues, managers expose their companies to thousands of dollars in fines by auditioning waiters. A successful manager goes beyond following the established procedures by having the foresight to seek professional guidance to ensure that company employment practices are in accordance with the law.

For fresh insight into how your business’s employment practices can become a recipe for success contact our office at info@immigrationcompliancegroup.com or call 562 612.3996.

Please refer to our informative Employer Resource Center for more, and here for a list of our services and solutions.

Tags: Employment Eligibility Verification, Food Service, I-9 Compliance, I-9 Fines, I-9 Form, I-9 Penalties, Legal Workforce, Restaurant Hiring, Restaurants, Undocumented Workers, Waiters, Worksite Enforcement

Posted in I-9/E-Verify News, ICE, Immigration News | Comments Off on I-9 Form: Recipes For Success | Lessons Learned as a Restaurant Manager

Friday, April 27th, 2012

One of the most important questions in the mind of both employer and employee is: What if information about the employee is wrong – can they fix inaccurate information about themselves in E-Verify?

One of the most important questions in the mind of both employer and employee is: What if information about the employee is wrong – can they fix inaccurate information about themselves in E-Verify?

If E-Verify is unable to automatically verify an individual’s status in order to authorize employment, a Status Verifier will manually review the information and conduct searches of other Federal government databases and, where necessary, will update any underlying information contained within the various DHS databases queried. After a result is returned on an employment authorization query, E-Verify provides two methods of information correction and redress for employees. If an employee receives a Tentative Non Confirmation, or TNC, they may correct their information through the Social Security Administration (SSA) or DHS.

After the verification process is complete, individuals have the opportunity to access and correct their information through the Freedom of Information Act (FOIA) or Privacy Act (PA) process.

We link to more E-Verify Privacy FAQs and our I-9 Employer Resource Center

Immigration Compliance Group specializes in business immigration and employer compliance matters related to audits, training and policy development.

Tags: Department Of Homeland Security (DHS), E-Verify, E-Verify News, E-Verify Privacy, E-Verify Self Check, Employment Eligibility Verification, I-9, I-9/E-Verify News, I9 Policies, ICE, Legal Workforce, Worksite Enforcement

Posted in Department Of Homeland Security (DHS), I-9/E-Verify News, ICE, Immigration News | Comments Off on E-Verify Privacy Issues | News from Immigration Compliance Group

Friday, March 9th, 2012

In a transcript released today of ICE Director John Morton’s testimony before the House Committee on Appropriations, Subcommittee on Homeland Security Hearing on The President’s Fiscal Year 2013 budget request for ICE, the message was clear….ICE intends to keep the pressure on employers with a continued focus on I-9 audits this year, as stated below in his statement concerning worksite enforcement:

In a transcript released today of ICE Director John Morton’s testimony before the House Committee on Appropriations, Subcommittee on Homeland Security Hearing on The President’s Fiscal Year 2013 budget request for ICE, the message was clear….ICE intends to keep the pressure on employers with a continued focus on I-9 audits this year, as stated below in his statement concerning worksite enforcement:

“We are focused on smart and effective enforcement of our immigration laws, including making sure that employers have the tools they need to maintain a legal workforce and face penalties if they knowingly violate the law.

Employment opportunities remain a primary motivation for aliens seeking illegal entry into the United States. By focusing on employers that are willing to hire illegal workers, we can eliminate the incentive that leads illegal aliens to violate our nation’s immigration laws. Since January 2009, ICE has audited more than 6,468 employers suspected of hiring illegal labor, debarred 521 companies and individuals, and imposed more than $76.4 million in financial sanctions. This focus will continue this coming fiscal year.

We have also established the ICE Mutual Agreement between Government and Employers program (IMAGE) — designed to promote voluntary compliance, educate employers about best practices and help companies train their employees to comply with the nation’s immigration-related employment laws. Last year, ICE entered into IMAGE agreements with well-known companies, including Chick-fil-A, Smoothie King, Best Western, Toyota, Tysons Food, and Kelly Services, among others. These companies agree to use E-Verify, conduct self-audits, and submit to an ICE audit. In FY 2013, ICE will continue to expand IMAGE outreach nationwide and provide regional and local IMAGE training conferences to increase voluntary compliance among key employers.”

This information should come as no surprise to our readership, who are very well informed. We would, however, like to remind you that a good faith effort is the primary consideration by ICE when determining final penalties in their worksite audits and investigations. To establish a good faith effort, have an outside audit performed by an experienced professional to determine what problems you really have; correct your paperwork, get everyone properly trained; create a written SOP statement to get everyone on the same page and enlisted in the process of maintaining a compliant workforce; enrolling in E-Verify is also recommended.

We invite you to contact our firm regarding any compliance questions/issues that you have, 562 612.3996, or by email, info@immigrationcompliancegroup.com. Check out our Employer Resource Center at www.I-9Audits.com, and our list of services and solutions.

Tags: E-Verify, Employer Compliance, I-9 Audits, I-9 Form, I-9 Policy, I-9 Training, ICE, ICE Audits, ICE investigations, John Morton, Legal Workforce, SSA No-Match, Worksite Enforcement

Posted in I-9/E-Verify News, ICE | Comments Off on ICE Reminds us of Continued Focus/Pressure on Worksite Enforcement

Tuesday, March 6th, 2012

We have heard many recent reports that ICE will step up the pressure on its I-9 Field Agents to surpass the number of I-9 audits they performed in 2011, and that they will be looking at various industries such as employers in critical food, energy, and infrastructure industries. In June 2011, ICE did not specify which businesses would be specifically targeted, but did say that immigration agents would focus on seventeen sectors including agriculture, financial services, nuclear reactors, water treatment, and health care.

We have heard many recent reports that ICE will step up the pressure on its I-9 Field Agents to surpass the number of I-9 audits they performed in 2011, and that they will be looking at various industries such as employers in critical food, energy, and infrastructure industries. In June 2011, ICE did not specify which businesses would be specifically targeted, but did say that immigration agents would focus on seventeen sectors including agriculture, financial services, nuclear reactors, water treatment, and health care.

It has been recently reported by the Farm Employer’s Labor Service (FELS) that the EVP of NCAE (National Council of Agricultural Employers) was informed by credible sources that ICE field agents will once again focus their I-9 audit investigations on high-profile agriculture and restaurant employers to surpass their 2,496 I-9 audits and 3,291 work site enforcement cases conducted in 2011. More specifically, they are again (no surprise) targeting high-profile/maximum press coverage employers, the biggest farms and restaurants, and employers who were previously audited and/or had issues with DOL or DHS in the past – who can now expect to be be revisited in 2012.

With good faith effort being one of the most important rules applied in ICE enforcement audits and investigations, it is recommend that all employers get their ‘houses in order’ as it relates to I-9 employment verification eligibility compliance. We would strongly suggest that you put your emphasis on retaining an outside expert to perform a thorough I-9 audit of your active and inactive I-9 forms to really get a handle on problems and reoccurring issues buried in your I-9 forms. This step alone can save you hundreds of thousands of dollars, as well as the potential of losing employees and recruitment and re-training costs. Then get your staff trained and don’t let anyone not properly trained be involved with hands-on I-9 functions. Next, establish a written compliance statement outlining the SOP that your company will follow — a plan that makes sense for your business……then implement it, and be diligent in your efforts to create and maintain a compliant workforce showing a good faith effort to comply with I-9 regulations to the best of your knowledge and ability. Lastly, avail yourself of reliable information from skilled professionals that report on compliance issues – subscribe to a newsletter and a blog so that you can stay ahead of the game. You should check out our free information – both blog and newsletters.

We invite you to contact our firm to discuss your compliance issues, info@immigrationcompliancegroup.com or call 562 612.3996.

:::::::::::::::::::::::::::

Immigration Compliance Group focuses its practice on corporate employment verification compliance and US and Canadian inbound business immigration. Our team has a depth of experience in providing uniquely tailored services and solutions to assist clients in developing comprehensive employment authorization and immigration-related compliance. We conduct onsite and offsite I-9 audits for companies of all sizes, design training curriculum to assure that staff is knowledgeable concerning the management of their I-9 program, and we assist with policy development so that our clients have a plan and strategy that assures their compliance in a manner that makes sense for their business and evidences their good faith in establishing a compliant workforce.

Tags: E-Verify, Employer Compliance, I-9, I-9 Audits, I-9 Form, I-9 Penalties, I-9 Training, I-9 Updates, ICE, ICE Agents, ICE Audits, Immigration Compliance Group, Legal Workforce, NOI, SSA No-Match, Worksite Enforcement

Posted in Department Of Homeland Security (DHS), I-9/E-Verify News, ICE | Comments Off on I-9 News Update: Industries that ICE is Targeting

Monday, January 30th, 2012

This brochure outlines some excellent Do’s and Don’ts pertaining to how to interact with employees during an ICE audit; however, these suggestions additionally apply to all audit situations such as outside 3rd party audits by attorneys or compliance experts, as well as internal self-audits.

This brochure outlines some excellent Do’s and Don’ts pertaining to how to interact with employees during an ICE audit; however, these suggestions additionally apply to all audit situations such as outside 3rd party audits by attorneys or compliance experts, as well as internal self-audits.

It is recommended that you have an established procedure for interacting with employees whose I-9 forms require correcting; i.e, how to inform them that you are seeking information from them, what to communicate to them, and how much time to allow them to respond.

Should you wish to discuss the particulars of your compliance program, please feel to contact our office for more information.

::::::::::::::::::

Leslie Davis is the Managing Director of Immigration Compliance Group and is an expert in employer compliance matters. The firm also specializes in US and Canadian business immigration.

Tags: E-Verify, Employer Compliance, EMPLOYMENT ELIGIBILITY, I-9 Audits, I-9 Compliance, I-9 Corrections, I-9 Fines, I-9 management, I-9 process, ICE Audits, ICE regulations, Legal Workforce, SSA No-Match, Worksite Enforcement

Posted in I-9/E-Verify News, ICE | Comments Off on I-9 Best Practice Audit Recommendations from OSC

Thursday, December 15th, 2011

OSC is conducting a free, live webinar series on Worksite Discrimination. If you’re a worker or worker advocate, they have a monthly worker/advocate track webinar. Employers/HR professionals are invited to join their monthly OSC Employer Training webinar. The webinars are conducted live from OSC’s headquarters in Washington, DC. You might want to check this out.

Here is a link to the OSC Powerpoint used in today’s Employer Worksite Discrimination Webinar. It was a very informative and well done presentation.

Should you wish to discuss how best to implement policies and procedures that will enhance your compliance program, we’d be glad to hear from you: info@immigrationcompliancegroup.com or 562 612.3996.

Tags: Citizenship Discrimination, DOJ, I9 audits, I9 compliance, I9 form, ICE, ICE investigations, Legal Workforce, National Origin Discrimination, NOI, OSC, Worksite Discrimination, Worksite Enforcement

Posted in I-9/E-Verify News, ICE | Comments Off on OSC Worksite Discrimination Webinars

Amendments to The

Amendments to The